Controls carried out

1 - PURPOSE OF THE CONTROLS :

The CARPA plays a role in preventing fraud (Article 241 of the Decree of 27 November 27, 1991).

An Order of July 5, 1996 (Article 8) lists the controls to be carried out.

The controls relate in particular to :

- the nature and description of the business,

- the source of the funds,

- the destination of the funds,

- the actual beneficial of the transaction,

- the link between the pecuniary settlement and the legal or judicial transaction carried out by the lawyer within the framework of his professional practice.

The various control points examined by the CARPA fully integrate, on the one hand, the obligations of vigilance in the fight against money laundering and the financing of terrorism, and, on the other hand, make it possible to prevent any forms of fraud.

If an operation poses a problem with regard to one or more of these control points, the CARPA may refuse it.

It should be stressed that Article 8 of July 5, 1996 predates the European Union's AML-FT Directives and their transposition into French domestic law applicable to lawyers. The legal profession thus established at its own initiative a system stipulating controls identical to those that lawyers are now obliged to make pursuant to the AML-FT legislation.

Beyond its perimeter of subjection to the AML-FT obligations stipulated by Article l 561-3 CMF, the CARPA must be able to verify the compliance of any handling of funds carried out by lawyers.

The controls carried out pursuant to Article 8 of July 5, 1996 apply to all the handling of funds processed by the CARPA, whether or not they relate to a transaction falling within the scope of Article L 561-3-I of the Monetary and Financial Code.

The protection of lawyers against attempted manipulation for the purposes of money laundering or terrorist financing is thus ensured, in all matters, as long as they themselves handle funds ancillary to the legal or judicial operations that they execute and are thus compulsorily subject to the CARPA controls.

Through the implementation of its controls, the CARPA is an essential player in the self-regulation system put in place by the Bar Association in the framework of the fight against money laundering and the financing of terrorism.

2 - ORGANISATION OF THE CONTROLS :

A / Management and control software for the handling of funds

The CARPAs all have specific software for managing and assisting in controlling the handling of funds.

The software allows lawyers to send to the CARPA their instructions and any supporting documents relating to their cases in a dematerialised way. This process facilitates the control of operations.

In addition, the data entered by the CARPA are systematically cross-checked with databases making it possible to identify the beneficial owners, PEPs, natural or legal persons subject to sanctions, targeted financial sanctions (freezing of assets), the countries at risk (grey or black list of the FATF, for example).

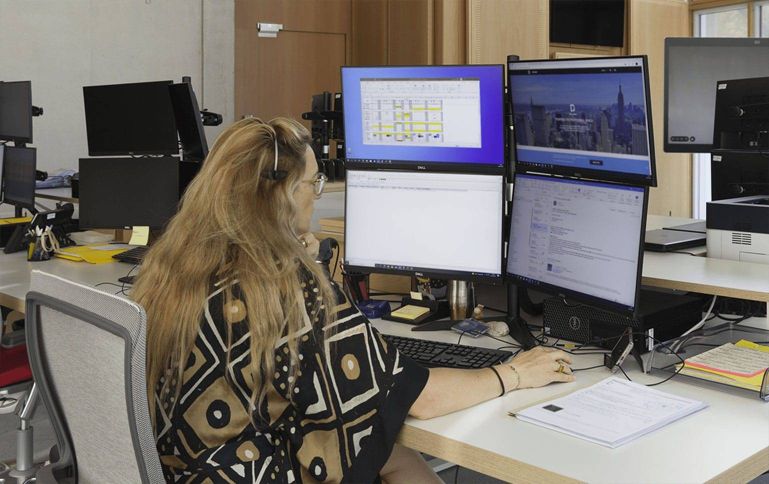

B / Appropriate human resources

Structured teams, trained in accordance with the risk-based approach, support operations through different levels of controls.

C / A risk-based approach

All the controls are organised by applying the risk-based approach method recommended by the FATF.

D / Operational complementariness between the controls carried out by CARPA and those of the bank

- The CARPA bank exercises its own controls.

It thus verifies itself the origin and destination of funds entering and withdrawn from the CARPA bank account.

In the event of an anomaly, it can file a declaration of suspicion with TRACFIN, without informing the CARPA.

- Professional secrecy to which the lawyer is strictly bound prohibits him from providing a bank with the elements contained in his file. It is not to be confused with banking secrecy.

On the other hand, and as indicated above, the lawyer cannot invoke this professional secrecy against the CARPA that carries out its controls under the authority of the President of the Bar Association.

The ethical control of the elements of the lawyer’s file, the financial flow of which handled by the CAPRA is necessarily an accessory, is thus provided by the CARPA which, contrary to the bank, can be provided with the documents.

- The controls carried out by the CARPA, on the one hand, and by its bank, on the other hand, are therefore complementary and make it possible to ensure proper application of the duty of vigilance while respecting the requirements of professional secrecy.

3 - VOLUMETRY OF THE CONTROLS :

The CARPAs annually control financial flows of more than €64 billion, representing an average of 8,300 transactions controlled per working day.